By David Brear, well known Corporate Frauds Blog guest Critic and Guide to the Amway Labyrinth:

‘If something sounds too good to be true, it probably is.’

(Anon. 20th century proverb)

I’d long-since given up being scandalised by the dozens of hard-pressed hacks who, during 2009, have parroted (without qualification or heavy irony) the following reality-inverting propaganda broadcast by the ‘Amway’ Ministry of Truth:

‘The Billionaire Owners of the Amway Corporation have created 3 Millions Independent Business Owners Worldwide with Total Annual Sales of $8.2bn.’

However, the ‘Amway’ mob must have fallen about laughing when a UK High Court Judge and three UK Appeal Court Judges also repeated (without qualification or heavy irony) elements of the same script in long-winded judgements which (apparently) took them many months to formulate. Sadly, the sanctimonious little gang of Bible-thumping charlatans who dreamed-up the comic-book ‘commercial’ fiction entitled: ‘Amway - the World’s Largest Direct Selling Company,’ have been allowed to peddle it as fact for the past 50 years. They have presented themselves as ordinary men turned selfless capitalist supermen and infiltrated traditional culture -surviving all less-than-intellectually-rigorous challenges whilst continuing to expand the scale of their lies year on year, until the ugly truth (lurking behind their seductive yarn) has become almost unthinkable to casual observers (including many politicians, regulators, Judges and journalists). In the adult world of quantifiable reality, the ‘Amway’ mob are economic alchemists whose miraculous ever-growing Multi-Billion Dollar Sales have never existed. Furthermore, the endless chain of wide-eyed dreamers who have temporarily become totally convinced that they owned a share of them, can in no way be accurately described as ‘Independent Business Owners’. This reality-inverting term is merely the ‘Amway’ mob’s own arbitrary definition of their victims (some of whom have lost everything and committed suicide).

Let’s face it, how (in the cold light of day) can the world continue to accept that:

Richard DeVos and Jay VanAndel (a couple of ambitious, but penniless, WWII veterans), became billionaires by inventing a new form of infallible, philanthropic capitalism based on the ‘Christian-inspired principle of helping others to succeed?’

Recently, however, I didn’t know whether to laugh or cry when I read the following thoughtless headline on the BBC News Website:

'Bernard Madoff has been given the maximum prison sentence of 150 years for masterminding a massive fraud that robbed investors of $65bn (£40bn).’

Even now, with the benefit of hindsight, the majority of commentators have completely failed to grasp that what Madoff steadfastly pretended to be the ‘World’s Largest Hedge Fund’ was nothing more than a comic-book ‘commercial’ fiction which, for the best part of 20 years, he was allowed to peddle as fact. He presented himself as an ordinary man turned selfless capitalist superman and infiltrated traditional culture - surviving all less-than-intellectually-rigorous challenges whilst continuing to expand the scale of his lies year on year until the ugly truth (lurking behind his seductive yarn) became almost unthinkable to casual observers (including many politicians, regulators, Judges and journalists). In the adult world of quantifiable reality, Madoff was a economic alchemist whose miraculous ever-growing multi-billion dollar trading profits never existed. The wide-eyed dreamers who became totally convinced that they owned a piece of them, can in no way be accurately described as ‘Investors.’ This reality-inverting term was merely Madoff’s own arbitrary definition of his victims (some of whom lost everything and committed suicide). In fact, when Madoff was finally arrested, less than $1bn remained under his control.

Let’s face it, how (in the cold light of day) could the world have accepted that:

Bernie Madoff (an ambitious, but penniless, lifeguard), became a billionaire by inventing a new form of infallible, philanthropic capitalism which enabled him to invest on the stock market and always show a profit, no matter what the overall trading conditions were?

or that:

Bernie Madoff was prepared (because of his Jewish-inspired Principles) to share the secret of his success with others?

At the risk of stating the obvious, if ten individuals each give you ten coins, then, no matter how you divide the resulting one hundred coins, it is impossible for you to give all your contributors a greater number of coins than they started with. In technical terms, this is an elementary example of an unviable, centrally-controlled, closed system of economic exchange; in that, since it has no consistent source of external revenue, it can have no possibility of generating a profit for the bulk of its contributing participants. The same incontrovertible logic applies if your contributors number one hundred, one thousand, one hundred thousand, one million or even one hundred millions. Unless the person(s) receiving the coins possesses the superhuman power to suspend the laws of physics and miraculously create more coins from nothing, then their number remains finite. Any claim to the contrary is a lie, and lying to people to get their money is fraud which is a form of theft.

A pyramid scam can be essentially defined as:

1). Any systematic fraud wherein an unviable, centrally-controlled closed-market is maliciously promoted as a viable, decentralised, open market from which any contributing participant can expect to receive a future material benefit.

2). Any self-perpetuating deception wherein the self-gratifying group-delusion that an authentic system of economic exchange exists which can keep generating an incremental material benefit for all its contributing participants if they just find further contributing participants, who, in turn just find further contributing participants, etc. in an infinitely expanding, geometric progression, is maliciously established for the purpose of human exploitation.

A pyramid scam can, therefore, be more accurately described as a ‘premeditated closed-market swindle.’ In everyday terms, it is the peddling of the finite as infinite, or ‘Alchemy’ applied to economics. Consequently, there can be no doubt that Bernie Madoff ran the most-widely understood form of ‘closed-market swindle.’ These can be technically defined as:

Those without tangible specificity (popularly known as: ‘Snowball,’ or ‘Ponzi,’ schemes or ‘Money Games’); wherein the instigators counterfeit, and/or subvert, a simple corporate structure in which they arbitrarily, and falsely, define themselves as ‘Commercial Sponsors’, ‘Fund Managers’, etc. Then, by maintaining an absolute monopoly of information presented using a constant repetition of further, thought-stopping ‘commercial’ key words and images combined with pseudo-economic mystification, deceive members of the public into becoming, and to deceive others into becoming, the unconscious victims of, and contributing participants in, a counterfeit ‘Investment Scheme’ without a consistent source of external revenue (due to the fact that the instigators’ hidden motive is merely the acquisition of victims’ money) in which victims are arbitrarily, and falsely, defined by the instigators as ‘Investors,’ but over which the instigators retain absolute control of its means of exchange.

The graphic description, ‘Snowball scheme,’ stems from the fact that when the number of victims reaches a critical mass, belief in the Utopian myth of a miraculous system to multiply money, begins to roll-along and grow under its own momentum. ‘Closed-market swindles’ can, therefore, also be described using any traditional allegory illustrating collective delusion: the ‘Emperor’s New Clothes’; the ‘Blind Leading the Blind’; the ‘Ship of Fools’; etc. However, the phenomenon is now perhaps best described as an organic computer virus - a contagious parasite that needs human minds to give it existence. Once it has found a vulnerable point of entry, the virus proliferates and survives in traditional culture, because carriers systematically pass it on via their social contacts. When explained in these accurate deconstructed terms, the psychology driving ‘closed-market swindles’ is indistinguishable to that driving any other self-gratifying, pseudo-scientific delusion. New adherents often exhibit euphoria, but certain converts can become completely dissociated from external reality; experiencing a prolonged psychotic episode. That said, in their most well-known form, ‘closed-market swindles’ are unsustainable. Although a proportion of illegal gains can be used to maintain the temporary illusion of authenticity, when the supply of new converts runs out, and/or too many adherents begin to demand their fictitious profits, the virus writers (unless they become deluded themselves) are forced to abscond with the cash. The authorities are only hit by a storm of complaint when the core-group of victims suddenly reconnects with external reality.

Bernie Madoff is an almost unique case, in that (although he has apparently withheld the whole truth about his activities in order to protect his criminal associates) he gave himself up to the authorities, pled guilty to fraud and allowed himself to be held to account. The once mighty Madoff has now been described as ‘the most-hated man in America.’ However, given the wider evidence, next to the ‘Amway’ mob he looks like a boy scout. Behind their sanctimonious act, what the ‘Amway’ mob released on a vulnerable 1950s America was a virulent new strain of premeditated closed-market swindle, which (today) can be defined as:

Those with tangible specificity (known as ‘Multilevel Marketing,’ or ‘MLM,’ or ‘Network Marketing,’ or ‘Networking,’ or ‘Direct Selling,’ or ‘Self-Directed Income,’ or ‘SDI,’ scams); wherein the instigators create, and/or subvert, a mystifying series of (apparently independent) corporate structures in which they arbitrarily define themselves as ‘Manufacturers,’ and/or ‘Suppliers,’ of ‘Exclusive Products,’ and/or ‘Services,’ and as ‘Commercial Sponsors’ then, by maintaining an absolute monopoly of information presented using a constant repetition of further thought-stopping ‘commercial’ key words and images combined with a cocktail of pseudo-scientific mystification, deceive members of the public into becoming, and to deceive others into becoming, the unconscious victims of, and contributing participants in, a counterfeit ‘Direct Sales Scheme’ (without a consistent source of external revenue due to the fact that the products, and/or services, are kept at such a banal quality, and/or high price, as to render them effectively unsaleable on the open market) in which victims are arbitrarily defined by the instigators as: ‘Independent Business Owners, Self-Employed Distributors,’ etc., but over which the instigators retain absolute control of not only its means of exchange, but also over its means of production and distribution and its system of dispute-resolution.

In effect, the ‘Amway’ mob originally instigated a more mystifying (and, therefore, more sustainable) version of a Ponzi scheme where illegal internal payments were arbitrarily and falsely defined by them as ‘sales.’ Victims were generally honest, law-abiding Christian folk manipulated by their existing beliefs and instinctual desires. When, inevitably, they lost money, on paper (because they were arbitrarily and falsely defined as ‘Independent Business Owners’) it appeared to be the participants own fault. Many were too financially weakened, and/or embarrassed, and/or guilt-ridden, to confront external reality and complain. They’d often been recruited by a friend or relative, and, in turn, they’d tried to recruit their own friends and relatives (making the truth even more unthinkable).

Unfortunately, the ‘Amway’ mob didn’t stop there.

Copyright David Brear July 2009

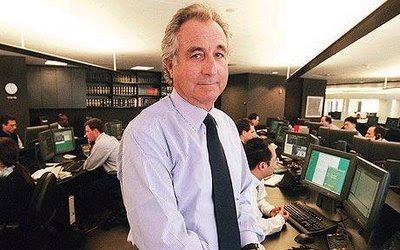

Bernie Madoff at the helm of his 'ship of fraud' in happier times, all represented as legitimate business:

No comments:

Post a Comment